Have you heard about DoorDash and wondered if you are eligible to become a Dasher? DoorDash is one of the leading food delivery platforms, offering flexible earning opportunities for individuals looking to work on their terms. In this article, we’ll explore the age requirement for DoorDash drivers, answer other commonly […]

Ready to discover a nifty trick that’ll let you pay for your Uber rides with cash? You heard it right – forget about fumbling for your credit card or worrying about those monthly bills. In this guide, we’ll spill the beans on how to pay cash with Uber and show […]

In today’s digital age, ride-sharing services have revolutionized the way we get around, providing convenience and flexibility like never before. One such prominent platform that has reshaped the transportation landscape is Uber. Whether you’re a frequent rider or considering becoming an Uber driver, it’s crucial to understand the cost dynamics […]

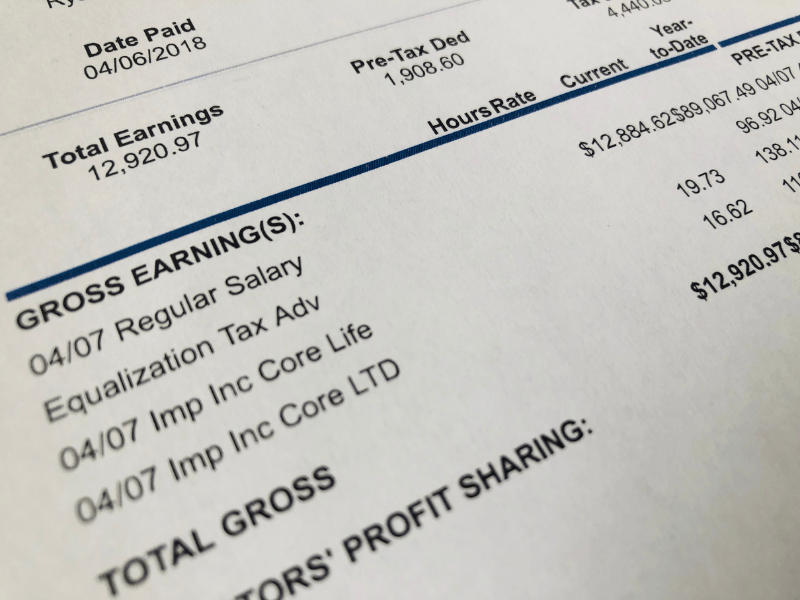

If you’re an Instacart shopper, you know that earning a steady income is essential. However, when it comes to accessing an official Instacart pay stub, you may find yourself wondering if Instacart provides them. In this blog post, we’ll discuss Instacart pay stubs, explore alternative methods to verify your […]

Are you a gig worker looking to provide proof of income as a freelancer? Whether you’re driving for Uber, delivering for DoorDash, or providing services on other gig platforms, proving your income can be a real challenge. Traditional proof of income documents like pay stubs and tax returns may not […]

Building business credit is essential for any entrepreneur who wants to establish a solid financial foundation to maximize their growth potential. Business credit measures a company’s ability to borrow money, access credit lines, and establish relationships with vendors and suppliers. By building strong business credit, you can increase your access […]

As a Lyft driver, it’s important to maximize your time on the road and earn as much as possible. With the right Lyft tips and tricks to boost your income, you can improve your passenger rating and have a successful and fulfilling driving career. In this blog, we’ll cover everything […]

If you’re on the lookout for another way to earn extra income, driving with Lyft is a terrific option. There has never been a better time to start driving. This guide will show you how to make money driving for Lyft. We’ll go through everything, from the factors that influence […]

Do you drive for Uber or another rideshare company? If so, then you’re a self-employed independent contractor. This means you’re responsible for paying your taxes. The entire process can be a little confusing, especially if you’re unfamiliar with it. So today, we’ll walk you through everything you need to know […]