500 Dollar Advance

Get Fast Cash with a $500 Cash Advance from Giggle Finance

When unexpected expenses arise, a $500 cash advance from Giggle Finance can provide the quick funding you need to cover them. Our cash advance service allows you to borrow up to $500, which can be repaid on your next payday or in installments over several months.

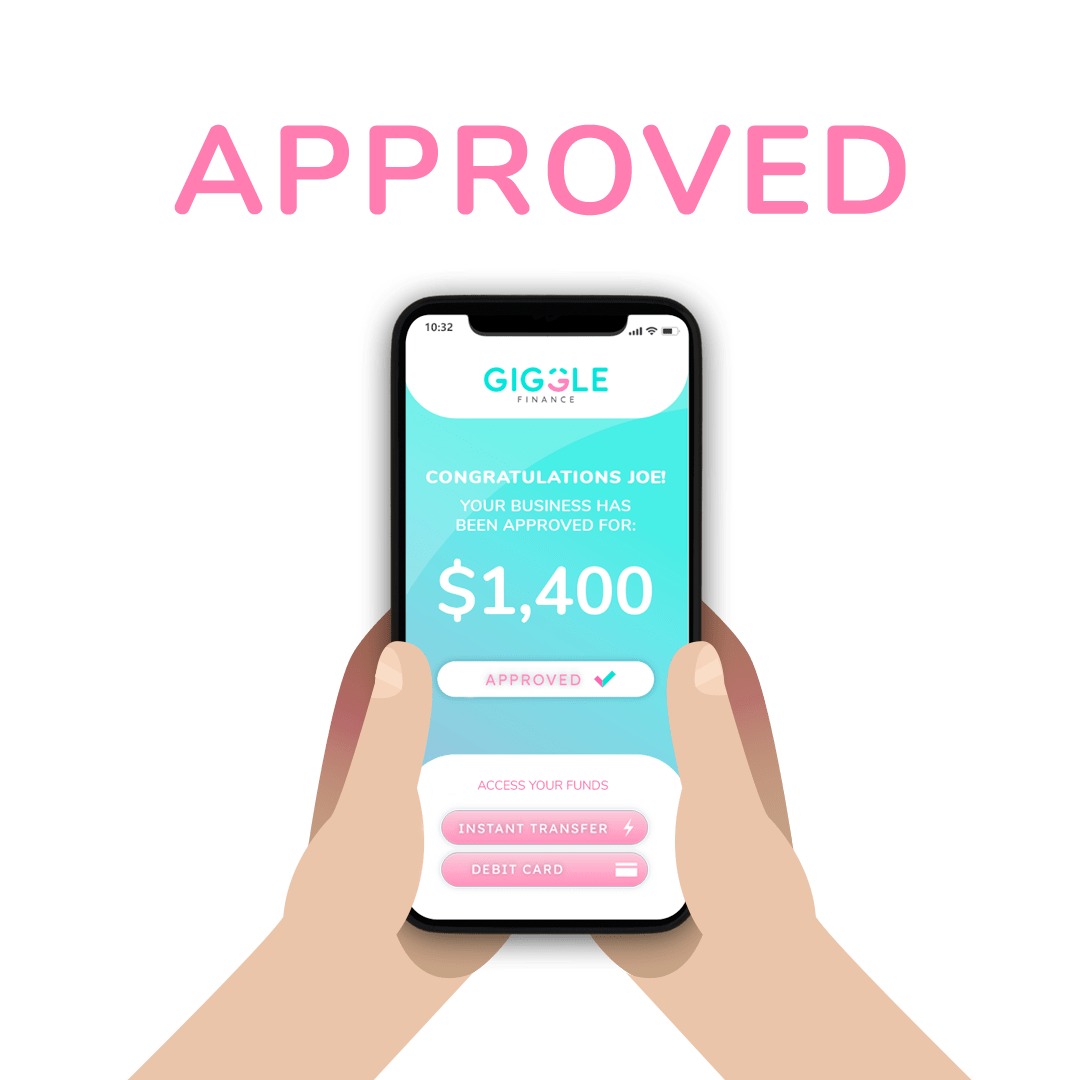

With our easy online application process, you can get approved for a $500 cash advance in minutes, and receive the funds in your bank account almost instantly. Plus, our cash advance service is designed to be flexible and convenient, with no hidden fees or prepayment penalties.

What is a 500 Dollar Cash Advance?

A $500 cash advance is a short-term loan that provides you with $500 in cash to cover unexpected expenses or to bridge the gap until your next payday. Cash advances are typically repaid on your next payday or in installments over several months.

At Giggle Finance, we offer a $500 cash advance service designed to be quick, easy, and convenient, with no hidden fees or prepayment penalties. You can repay through several repayment options. You can even automate the repayment process by syncing your bank account with your loan. This will free up your time for more important stuff in case you’re leading a busy lifestyle.

Benefits of a 500 Dollar Cash Advance from Giggle Finance

There are several benefits of getting a $500 cash advance from Giggle Finance, including:

Easy online application: Our online application process is fast and easy, allowing you to apply for a cash advance from the comfort of your own home.

Quick access to funds: Our online application process makes it easy to apply for a cash advance, and you can receive funds almost instantly.

No credit requirements: You don’t need a high credit score or history to qualify for a Giggle advance or a 500-dollar loan. We’ll only need to review your bank statements to determine how much you’ll be able to borrow for your gig.

Flexible payment schedule: Payments are automatically debited from your account, so you don’t have to worry about overlooked due dates and late payment penalties.

No hidden fees or prepayment penalties: We believe in transparent lending, which is why we don’t charge any hidden fees or penalties for prepaying your loan.

Who Are We?

Giggle Finance is a company that offers financial assistance to freelancers, independent contractors, and other members of the gig economy. Delivering transparent and fast financing to our clients, we aim to build a better financial world through technology and innovation.

Why Choose Giggle Finance?

At Giggle, our mission is simple: to provide fast and transparent financing to business owners, freelancers, independent contractors, and 1099 workers who need it the most.

1. Simple Application Process

We know you have a lot on your plate, so our online application process is specifically designed to accommodate your busy schedule. Online applications take less than 8 minutes to complete.

2. Qualify for Up to $10,000 and Access Your Funds in Minutes

Giggle advance is available for businesses and freelancers that need fast access to additional capital. You can qualify for up to $10,000. Once approved, we’ll instantly wire the money into your account so you can immediately use the money when you need it the most.

3. No Credit Requirements

You don’t need a high credit score or history to qualify for a Giggle advance or a 500 dollar loan. We’ll only need to review your bank statements to determine how much you’ll be able to borrow for your gig.

4. No Hidden Fees

Transparency and integrity are part of Giggle Finance’s core values. We want to treat our customers and our Gig community with the respect and honesty they deserve. That’s why our online applications and contracts are easy and straightforward to understand with no hidden fees involved; what you see is what you get, ALWAYS.

5. Flexible Payment Schedule

Payments are automatically debited from your account, so you don’t have to worry about overlooked due dates and late payment penalties.

6. Fully Secure

Our system uses 256-bit encryption, so we could never store, view, or display your personal information and passwords. We designed our platform with your privacy and security in mind, making Giggle Finance the safest, fastest, and most convenient way to fund your business.

How to Qualify for a Giggle Advance

We like to make it simple for busy gig workers, so your 500 dollar loan applications don’t require much. The 2 main requirements are:

- Bank account with online access

- At least three months in business

A Simple, No Fuss Application

Giggle Finance’s online application only takes less than 8 minutes to complete. You just need to tell us a little about your business and securely connect your banking information. Approval is instant, and you’ll receive your funds shortly after approval.

Here’s how to apply:

Step 1: Complete the online application

We’ll only need basic information about your business and your banking details. Don’t worry; we’ll keep your data safe, and they’re never stored, viewed, or displayed.

Step 2: Wait for approval.

Once you’ve submitted your application, approval is granted instantly. You’ll be able to review the terms, rates, and how much you qualified for.

Step 3: Receive your Giggle advance.

After approval, we’ll wire the money into your account immediately.

How to Use a Giggle Advance

You can use the funds from a Giggle advance for almost any type of expense, but here are some of the most common ways to use it:

1. Marketing and Advertising

Many gig workers forego paying for marketing and advertising because they usually cost a lot of money upfront. However, marketing is a necessary expense that you need to invest in because it improves brand awareness and visibility and allows you to connect with your customers. You can use a gig advance to pay for the services of marketing agencies or promotional materials like SEO, social media ads, radio spots, and more.

2. Having a Cash Cushion

Cash cushions are essential in addressing unforeseen expenses, sales fluctuations, and shifts in the market. Seasonal businesses, gig workers, and freelancers must have enough cash to offset irregularities in revenue. Giggle Finance’s fast approval and funding will give you peace of mind knowing that you’ll have access to funding when you need it.

3. Increase Working Capital

Increasing capital is one of the main reasons why gig workers take out a $400 to $2000 loan. Inconsistent revenue and seasonal sales can negatively affect your cash flow. You can use the funds of a Giggle advance to pay for day-to-day expenses and bridge cash flow gaps so you can continue running your gigs.

Frequently Asked Questions

I need 500 dollars now. What can I do?

Borrowing from friends and family can be an option, but it’s important to consider the potential strain it could put on your relationship if you’re unable to repay the loan. A payday loan may be an option if you prefer to keep your financial matters private. But, you need to keep in mind that payday loans often come with very high-interest rates and fees, so it’s essential to carefully consider the costs and whether you can afford to repay the loan on time.

I need a 500-dollar loan. Can I get it with no job?

It can be more challenging to get a loan without a job, as lenders often require proof of income. However, some lenders offer personal loans for people with bad credit or no job, but these loans may come with higher interest rates and fees. You may also need to provide collateral or a co-signer to secure the loan.

How fast can I get a $500 payday loan from a direct lender?

The time it takes to get a $500 payday loan from a direct lender can vary depending on the lender and their specific requirements. Some lenders may offer same-day or next-day funding, while others may take several business days to process and approve your application. It’s important to compare lenders and their terms to find one that can offer the fastest funding for your needs.

Can I get a $500 cash advance with a bad credit score?

It may be possible to get a $500 cash advance with a bad credit score, but it can be more challenging. Many lenders will require a credit check and may be hesitant to lend to borrowers with poor credit history. But, some lenders specialize in bad credit cash advances or payday loans, and borrowers may have more success working with them.

How much money can I get from bad credit payday loans?

The amount of money you can get from a bad credit payday loan will depend on the lender and your financial situation. Payday loans are generally meant to be small, short-term loans, often ranging from $100 to $1,000. Borrowers with good credit scores may get larger payday loans of up to $2,500 or more.

How should I repay my $500 cash advance?

The repayment terms for a $500 cash advance will depend on the lender and the type of loan. If you have taken out a payday loan, the lender may require repayment in full on your next payday. Other lenders may offer installment loans, which allow you to make payments over a longer period.

It’s important to make your loan payments on time to avoid late fees and additional charges, which can add up quickly. If you’re having trouble making your payments, reach out to your lender to discuss your options, such as a payment plan or deferment. Avoid taking out additional loans to pay off your existing debt, as this can lead to a cycle of debt that can be difficult to escape.

What to expect if I can’t repay a $500 cash advance on time?

If you can’t repay a $500 cash advance on time, you may be charged additional fees and interest, which can add up quickly. If you continue to miss payments, the lender may report your delinquency to credit bureaus, which can negatively affect your credit score. In some cases, the lender may also take legal action to collect the debt.

Do I need collateral to get a $500 loan?

It depends on the type of loan you’re applying for. Some lenders may require collateral for a $500 loan, particularly if you have bad credit. However, many payday loans and personal loans are unsecured, meaning you don’t need to provide collateral to secure the loan.

How much will a $500 payday loan cost?

The cost of a $500 payday loan will depend on the lender and the state where you live. Payday loans are typically short-term loans with high-interest rates and fees, so the total cost of the loan can add up quickly. To get a sense of how much a $500 payday loan will cost you, you can check the lender’s website for information on interest rates, fees, and repayment terms. However, it’s important to remember that payday loans should be used as a last resort, as they can be costly and can trap borrowers in a cycle of debt.

Disclaimer: Giggle provides Revenue Based Financing programs that are for business purposes only. Any mention of any loan product(s), consumer product(s) or other forms of financing are solely for marketing and educational content purposes and to help distinguish Giggle’s product from other comparable financing options available in the market.