We fund side hustles , small businesses , contractors , 1099s , self employed

This is how we Giggle

-

Simple Application Process

It only takes 8 minutes to complete our streamlined application process—we've tested it ourselves! No lengthy forms, just quick and easy steps to get you started. -

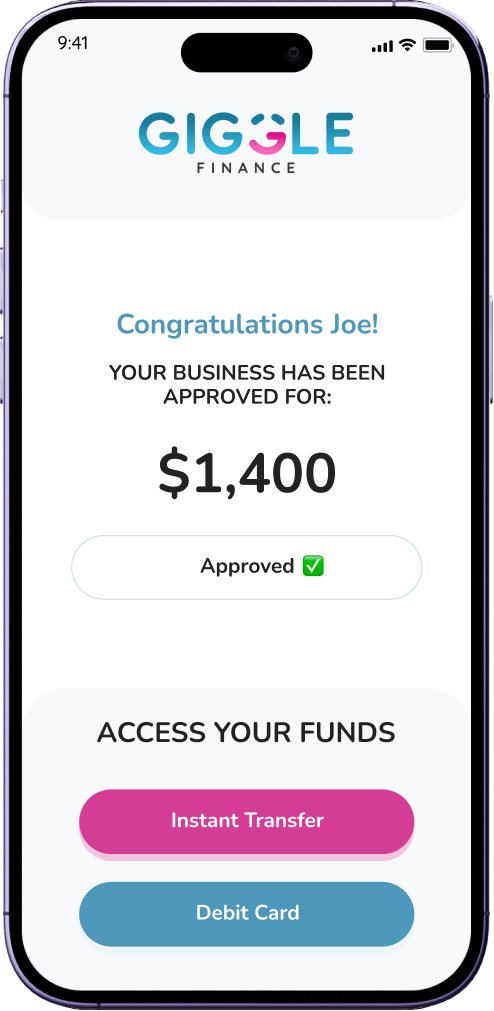

Access to Funds

Once approved, funds are deposited quickly into your connected account, so you can keep your business moving without delay. Fast access, no hassle! -

Funding up to $20,000

Depending on your business’s history and proven revenue, we can provide up to $20,000 in funding. We’ve got you covered to help you grow and scale your business. -

No Credit Requirements

This is revenue-based funding, so we don’t look at your credit score. Approval is based solely on your business income and revenue streams. -

No Hidden Fees

Utilizing revenue-based funding means there are no hidden or surprise fees—everything is transparent from the start. -

Instant Cash Available

We move at speed and deposit funds into your account as soon as possible. Get instant access to capital so you can focus on growing your business without the pain of costly delays.

How it Works ($10,000 in 8 minutes)

-

1

Apply

Complete our simple application

-

2

Connect Bank Account

Securely verify your bank account in minutes.

-

3

Approved

Instant approval. Review your terms in seconds.

-

4

Funded

Access your funds instantly!

Accidents, emergencies, and life all happen at full speed these days. Your financing partner should move just as quickly.

That’s why we’ve streamlined the process to approve your application and replenish your account within minutes. Giggle is the partner you can count on when hustle meets speed bumps (sometimes literally)!

Build Business Credit

Giggle reports to Experian and Transunion so every on-time payment builds your business credit and moves you forward at the same time. Our goal is to help set up your business or side hustle to build the life of your dreams and we’re always looking for new ways to make that happen!

Prepayment Discount

Your payments are tied directly to your weekly business revenue, making them affordable and manageable. Plus, when business picks up and you want to pay off early, you can prepay at a discounted rate! It’s just another way Giggle makes funding your business or side hustle easier and more affordable.

Who Qualifies?

-

Who qualifies for funding?

Independent contractors, freelancers, and small business owners with at least three months of 1099 or business income. -

What are your requirements?

To qualify, your business needs to be operational for at least three months, and you’ll need to connect your business bank account. We also require at least three months of 1099 or business income. -

How much do I need to earn to qualify?

You’ll need a minimum of $1,500 in your business bank account, with at least four deposits in the past month. Consistent income is key! -

Who doesn’t qualify?

If you’re W-2 only, you won’t qualify. However, if you’re a hybrid of W-2 and 1099/business income, you can still qualify for funding. -

Are there any states that don’t qualify for Giggle Financing Advance?

Currently, we don’t operate in New York, California, or Oregon. -

Is there anything else we look at to determine approval?

Yes, we also review factors like overdrafts, negative balances, chargebacks, and your average daily bank balance to ensure financial stability.