Financing Options for Drivers

Financing Options for Drivers

The rapid growth of ridesharing apps like Uber and Lyft has provided full-time and part-time job opportunities for people who want to earn an income on their own schedule. All that’s needed to be eligible is a decent car and a valid driver’s license to start earning.

However, there are certain expenses involved in becoming a driver for ridesharing apps, especially if you don’t have a car, or if the one you have needs an upgrade. Vehicle purchases, maintenance and upkeep can be expensive.

Do Rideshare Drivers Qualify for Loans?

Entrepreneurs rely on small business financing to pay for day-to-day expenses and emergencies. However, Uber and Lyft drivers will likely find it challenging to qualify for a loan due to the unpredictable nature of the industry, poor credit history, documentation requirements and employment status.

Lyft and Uber drivers often resort to payday loans with high interest rates and fees in times of emergency.

Fast and Transparent Financing for Ridesharing Drivers

Banks and credit unions may not finance the needs of ridesharing drivers, gig workers, and freelancers, but Giggle Finance will. We’re committed to providing accessible and transparent business financing for drivers, self-employed professionals, and small business owners.

Our financial platform is specifically designed to provide solutions that are personalized to work for your needs. Whether you want to pay for car repairs or cover personal expenses, Giggle Finance helps drivers secure the money they need whenever they need it.

Who We Are and What We Do

Giggle Finance is an online financing platform dedicated to helping independent contractors and 1099 workers access the funds they need in minutes through a Giggle business advance.

Customers can receive the advance by selling a portion of their future sales. The payments for the advance are automatically debited from your account, along with a small service fee.

The flexible payment terms are what make Giggle so popular among gig workers and rideshare drivers.

Why Choose Giggle Finance

1. No Credit Requirements

At Giggle Finance, we won’t ask for credit scores and ratings. Instead, we analyze your bank statements to see how much you can afford to borrow.

2. Fast and Easy Application Process

Proving your income can be a headache when applying for advances. We like to make it simple for busy rideshare drivers. The application process is simple and fully automated, it takes less than eight minutes to complete!

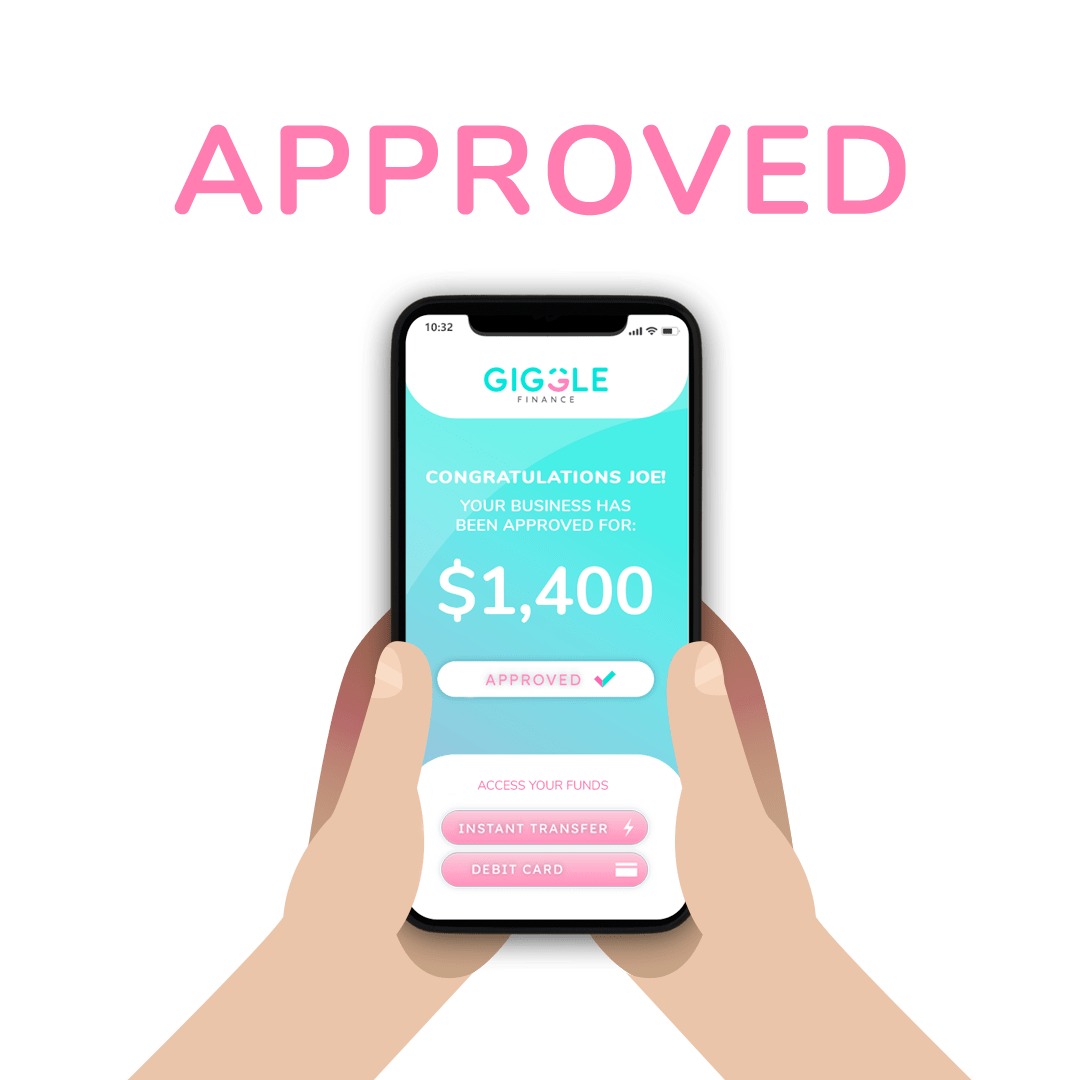

3. Qualify for Up to $10,000 and Access the Money in Minutes

Once approved, you can qualify for up to $10,000, and we’ll instantly wire the money into your account.

4. No Hidden Fees

At Giggle, we believe that every rideshare driver should have access to fast and transparent funding. We make sure that our contracts and application process are simple and easy to understand, without any hidden fees. No Surprises.

5. Fully Secure

Giggle Finance was designed with your privacy and security in mind. Our platform runs on 256-bit encryption, so your personal information and passwords are never stored or viewed. This is the safest and fastest way to access the funding you need.

How to Apply for a Giggle Advance

We know how busy rideshare drivers can be, so we made sure that our application process only takes less eight minutes to complete. Tell us a little bit about your business, securely connect your bank account, and access your money in minutes.

Step 1: Complete the online application

Fill out our simple online application and verify your bank account. Our application process is designed for easy and seamless navigation, but if you do have any trouble with it, our customer service representatives will gladly help. You can also check our Frequently Asked Questions section for more information.

Step 2: Get a decision

We’ll instantly approve your application so that you can review your terms in seconds.

Step 3: Get funded

Once approved, we’ll deposit the money into your account so you can access your funds instantly.

Reasons Rideshare Drivers Might Need a Giggle Advance

Rideshare drivers are considered independent contractors, which means that the company doesn’t generally shoulder their expenses incurred while driving.

A Giggle advance can help cover the costs of car repairs and upkeep, so you’re not stuck paying out of pocket.

Here are some of the reasons why rideshare drivers take out personal loans:

1. Maintain or Upgrade Your Vehicle

Full-time rideshare drivers work a minimum of 35 hours per week. Regular vehicle maintenance and occasional repairs are necessary to ensure the safety of both the driver and the passengers. Everything from a simple tire replacement to repair of a transmission is part of a regular maintenance schedule.

Uber and Lyft have certain vehicle requirements all drivers need to meet in order to work through their platforms. For example, the car you’re driving shouldn’t be more than ten years old, and the interior needs to be spotless, without any visible blemishes. Each state also has its own requirements regarding commercial vehicles. For example, New York City Uber drivers need to show proof of commercial insurance and TLC (taxi and limousine commission) driver’s license, among others.

A Giggle advance can pay for these expenses, so you don’t have to.

2. Purchase a Car

When repairs and maintenance are no longer viable, you may need to purchase a new vehicle. You’ll need to buy a brand new car or one that’s less than ten years old to meet the rideshare requirements. A Giggle advance can help cover a portion of vehicle purchases or a down payment.

3. Additional Working Capital

A Giggle advance gives you instant access to additional working capital to help pay for gas, parking fees, and other costs incurred while driving.

4. Refinance a Loan

It may seem counterproductive to take a loan out to pay off another loan, but debt refinancing is actually one of the most common reasons why rideshare drivers, self-employed professionals, and small business owners apply for a personal loan.

They often choose to refinance business debt because they’ve been offered a loan with better terms or rates, or they want to consolidate several loans into one.

Disclaimer: Giggle provides Revenue Based Financing programs that are for business purposes only. Any mention of any loan product(s), consumer product(s) or other forms of financing are solely for marketing and educational content purposes and to help distinguish Giggle’s product from other comparable financing options available in the market.