Get a $2000 Cash Advance From Giggle Finance!

Get a $2000 Cash Advance From Giggle Finance!

In life, there may be times when you have to deal with unexpected expenses. That’s why for many, knowing where to get that a $2000 cash advance is important to help cover an emergency cost or unplanned purchase.

Here at Giggle Finance, you can get a 2000 dollar loan without affecting your credit score. If you need this type of funding at the moment, here are the things you need to know:

Who Are We?

Giggle Finance is a financing platform that offers funding, in the form of a cash advance or other services to freelancers, independent contractors, and other members of the gig economy. Delivering transparent and fast financing to our clients, we aim to build a better financial world through technology and innovation.

How does a $2,000 personal loan work?

A $2,000 personal loan is an unsecured loan that can be used for various purposes, such as paying off debt, covering unexpected expenses, or making a large purchase. Personal loans typically have fixed interest rates and fixed repayment terms, meaning you’ll make the same payment each month for the life of the loan.

When you apply for a $2,000 personal loan, lenders typically review your credit history and other financial information to determine whether to approve the loan and at what interest rate. If approved, you’ll receive the loan funds as a lump sum, which you can then use to pay for your expenses.

To repay the loan, you’ll make regular payments to the lender over the term of the loan. The amount of each payment will depend on the interest rate, the loan term, and other factors. If you fail to make your payments on time, you may be charged fees, and your credit score may be negatively affected.

Can I get a $2,000 personal loan with bad credit?

Yes, it may be possible to get a $2,000 personal loan with bad credit, but it can be more challenging. Many lenders will require a credit check and may be hesitant to lend to borrowers with poor credit history. However, some lenders specialize in bad credit personal loans, and borrowers may have more success working with these types of lenders.

If you have bad credit, you may be charged a higher interest rate and may have to pay more fees than borrowers with good credit. You may also need to provide additional documentation or collateral to secure the loan.

To increase your chances of getting approved for a $2,000 personal loan with bad credit, consider improving your credit score by paying down debt, making on-time payments, and disputing any errors on your credit report. You may also want to shop around and compare rates and terms from different lenders to find one willing to work with you.

How fast can I get a $2,000 personal loan?

The time it takes to get a $2,000 personal loan can vary depending on the lender and the application process. If you apply for a loan online, you can receive a decision within minutes and get the funds deposited into your account almost instantly. However, the process may take longer if you apply for a loan in person or through a traditional bank.

To speed up the process, make sure you have all the necessary documentation ready, such as proof of income, proof of identity, and bank account information. You may also want to consider applying for a loan through a lender specializing in fast or instant loans, such as an online lender.

What are the pros and cons of a $2,000 personal loan?

The pros and cons of getting a $2,000 personal loan are as follows:

Pros:

Flexibility: A $2,000 personal loan can be used for various purposes, from consolidating debt to paying for unexpected expenses.

No collateral required: Unlike secured loans, personal loans are typically unsecured, meaning you don’t need to provide collateral, such as a car or house, to secure the loan.

Fixed interest rate: Many personal loans have a fixed interest rate, meaning your monthly payments will stay the same throughout the life of the loan.

Fast funding: If approved for a personal loan, you can receive the funds quickly, often within minutes or a few business days.

Cons:

Higher interest rates: Personal loans often come with higher interest rates than secured loans, particularly for borrowers with bad credit.

Fees: Some personal loans may have additional fees, such as origination or prepayment penalties.

Credit check required: Most lenders will perform a credit check when you apply for a personal loan, which can negatively affect your credit score.

Risk of default: If you’re unable to make your loan payments, you may be charged fees, and your credit score may be negatively affected.

It’s important to carefully consider the pros and cons of a $2,000 personal loan before applying and to make sure you can afford the monthly payments before signing on the dotted line.

Why Get Your $2000 Cash Advance From Us?

At Giggle Finance, we get it that sometimes you need money right away. Through our $2000 cash advance, you’ll be able to cover any unexpected expenses that come your way.

That being said, you might be wondering why you should choose us over other financial companies? Allow us to give you not one but eight reasons to do that.

1. Simple Application Process

Applying for a thousand dollar loan at Giggle Finance is easy and simple. Just go to our website, complete our application form, verify your bank account, and you’re golden.

2. Quick Access To Funds

Once you’ve submitted the application form and verified your bank details, all that’s left is to wait for the $2000 cash advance to be released, which takes only minutes.

3. No Credit Requirements

As we aim to serve members of the gig economy, our cash advance products don’t come with any credit requirements. So even with a bad or non-existent credit history, you can enjoy our services.

4. No Hidden Fees

At Giggle Finance, we don’t believe in hidden costs or fees. You won’t have to dish out any extra bucks just to take out quick cash advances from us.

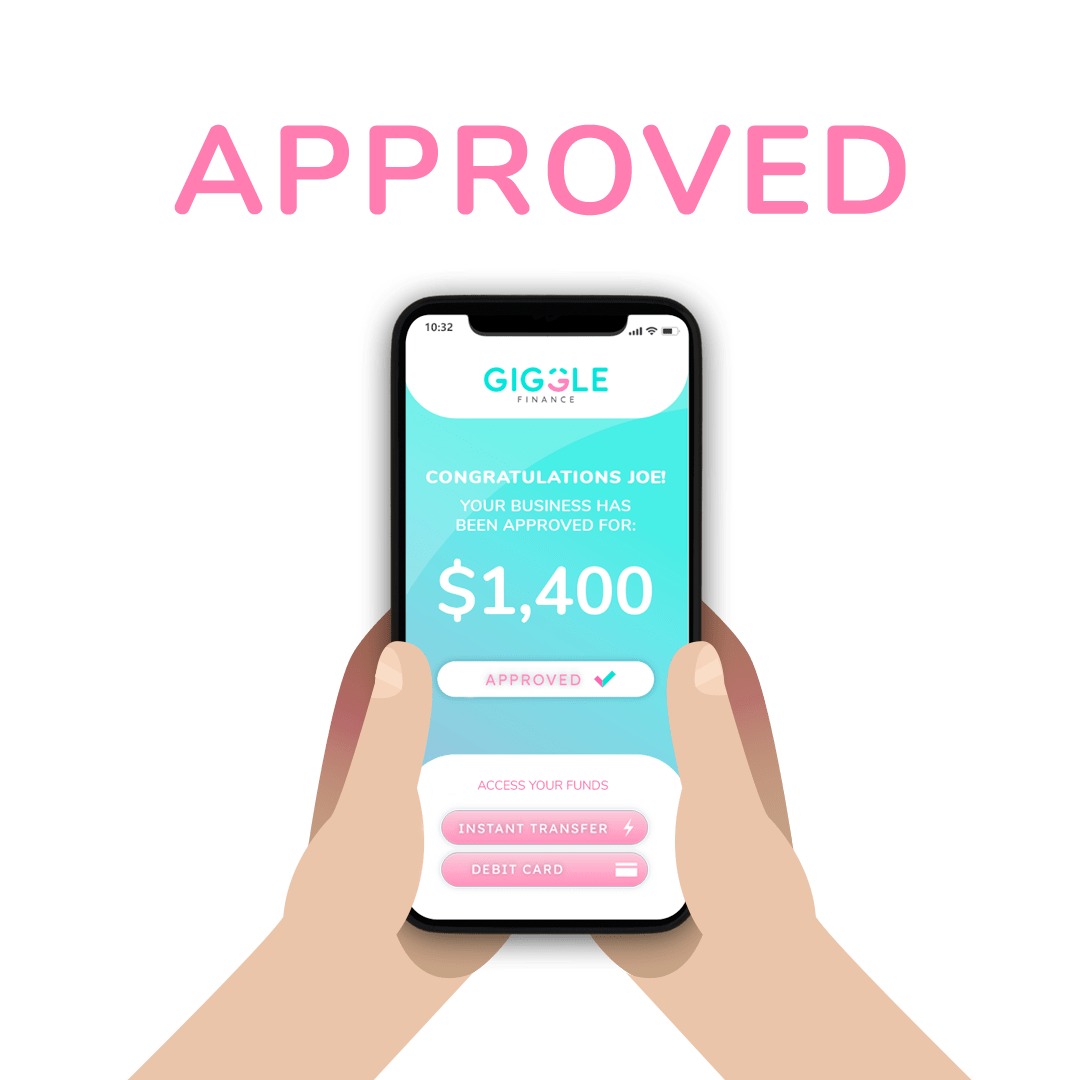

5.Instant Cash Available Via Debit Card Or Transfer

To make your life easier, our $2000 cash advance is available via debit card or transfer. This removes the need for you to deposit the money yourself.

6. Fully Secure Platform

Giggle Finance provides a secure online platform for our clients. Our website is easy to navigate and offers a variety of features that make it a convenient option for anyone in need of quick access to cash.

7. Flexible Payment Schedule

We understand that life doesn’t always go according to plan. That’s why our $2000 cash advance comes with a flexible payment schedule, allowing you to return the money at a more convenient pace.

8. Funding Up To $10,000

To top it off, Giggle Finance allows you to take out $500 up to $10,000 worth of funding. So in case the $2000 cash advance isn’t enough to cover your current financial woes, you can always come back for further assistance.

Who Qualifies For Our $2000 Cash Advance?

Giggle Finance is committed to powering the gig economy. If you’re one of the following, you can definitely take advantage of our $2000 cash advance:

1. 1099 Workers or App-Based Freelancers

Particularly those who work through apps like Uber, Lyft, Ride-share, Handy, Fiverr, Upwork, Airbnb, TaskRabbit, Care.com, and the like.

2. Independent Contractors or Self-Employed Individuals

Individuals who work as consultants, tutors, trainers, event planners, home health aides, and the like.

3. Small Businesses or US-Based Franchises

These include businesses that offer services in various industries, such as trucking, cabs, beauty salons, bodega and food trucks, lawn and pool care, and the like.

Please note that for self-employed professionals and small business owners, you must have been in operation for at least three months. This criterion allows us to assess your financial status and offer you the best terms possible.

How to Qualify for a $2000 Cash Advance

We like to make it simple for busy gig workers, so your $2000 cash advance applications don’t require much. The 2 main requirements are:

Bank account with online access

At least three months in business

A Simple, No Fuss Application

Applying and receiving your Giggle cash is made easier now more than ever. Apart from not impacting your credit score, you won’t have to worry about any fees to apply too! With our automated platform, you’ll get funded faster than you can say, “I need 2000 dollars now!”

Here’s how to apply:

Step 1: Complete the online application.

We’ll only need basic information about your business and your banking details. Don’t worry; we’ll keep your data safe, and they’re never stored, viewed, or displayed.

Step 2: Wait for approval.

Once you’ve submitted your application, approval is granted instantly. You’ll be able to review the terms, rates, and how much you qualified for.

Step 3: Receive your money.

Upon approval, your Giggle advance will be deposited directly into your designated bank account, granting you immediate access to the capital you require.

Frequently Asked Questions

Can I Get $2000 Funding Even With Bad Credit?

Usually, people have a hard time finding a $2000 loan with bad credit. With Giggle Finance, you can still get approved for financing, which is a great way to get the cash you need fast.

However, like other $2000 loans with no credit check, bad credit cash advances often come with higher interest rates. Lenders tend to see bad credit as a greater risk, making a higher interest rate necessary to offset some of it.

What Can I Use My $2000 Cash Advance for?

The best part about getting a $2000 cash advance is that you can spend it however you want. You can use it to consolidate your credit card debt, fund your overdue kitchen redecoration or even buy a used boat.

How Does Giggle Finance Keep My Information Secure?

Our platform employs 256-bit encryption, specifically designed to ensure your privacy and keep the information you provide private. We also don’t store, view, or display any of your usernames and/or passwords.

Is Giggle Finance Legit?

Yes! However, don’t just take our word for it. You can take the time to view the feedback left by our clients. Should you have any concerns or need clarification, please contact us by email at [email protected] or via phone at 888-820-7580. We are also at 3250 NE 1st Ave Unit 305, Miami, FL. We’d be more than happy to answer your questions, so get in touch with us today!

What is the difference between a payday loan and a small $2,000 loan?

A payday loan is a short-term loan usually due on the borrower’s next payday. These loans typically have sky-high interest rates and fees and can be difficult to repay. In contrast, a small $2,000 loan may have a longer repayment term and a lower interest rate, making it easier for borrowers to repay over time. Additionally, payday loans often require a post-dated check or access to the borrower’s bank account, while a small $2,000 loan may not require any collateral.

Is a $2,000 personal loan a good idea?

Whether or not a $2,000 personal loan is a good idea depends on the borrower’s financial situation. If the borrower needs the money for a necessary expense, such as a home repair or medical bill, and has a plan for repaying the loan on time, a personal loan can be a helpful tool.

However, taking out a personal loan may not be the best choice if the borrower is already struggling with debt or has a history of missed payments.

Additionally, borrowers should carefully consider the interest rate and fees associated with the loan, as well as any potential penalties for early repayment. Ultimately, it’s important to weigh the pros and cons and make an informed decision based on the individual’s financial situation.

Can you get a $2,000 personal loan with bad credit?

It may be possible to get a $2,000 personal loan with bad credit, but it can be more challenging. Many lenders will require a credit check and may be hesitant to lend to borrowers with poor credit history. However, there are some that specialize in bad credit personal loans, and borrowers may have more success working with these types of lenders.

The following are some basic tips you may want to follow if you find yourself in the position of needing a $2,000 personal loan with bad credit:

Check your credit report: Make sure there are no errors on your credit report that could be dragging down your credit score. If you find any errors, report them to the credit bureau to have them corrected.

Shop around: Not all lenders have the same requirements for credit scores, so it’s important to shop around and compare rates and terms from different lenders. Be prepared to pay higher interest rates and fees due to your bad credit.

Consider a co-signer: A co-signer with good credit can help you qualify for a loan and may also help you secure a better interest rate. However, remember that if you default on the loan, the co-signer will be responsible for repaying the debt.

Look into secured loans: If you have collateral, such as a car or savings account, you may qualify for a secured personal loan. With a secured loan, the lender can take the collateral if you fail to repay the loan.

Improve your credit score: While it may not be an immediate solution, taking steps to improve your credit score can help you qualify for better loan terms in the future. This can include paying down debt, making on-time payments, and disputing errors on your credit report.

Keep in mind that taking out a personal loan is a serious financial commitment. Before applying for a loan, make sure you can afford the payments and understand the terms and conditions of the loan.

What is considered bad credit when looking for a $2,000 personal loan?

Credit scores are typically used to determine whether a borrower has good or bad credit. A credit score below 580 is generally considered to be poor or bad credit. However, lenders may also look at other factors, such as the borrower’s income, employment history, and debt-to-income ratio, when determining whether to approve a loan. If you have bad credit, it’s important to shop around and compare lenders to find one that’s willing to work with you.

Apply For a $2000 Cash Advance Today!

If you’re in a bind and need some quick cash, Giggle Finance is a great option. By getting a $2000 cash advance from us, we’ll make sure you have all the money you need to cover any unexpected expenses.

So what are you waiting for? Go to Giggle Finance’s website and apply for a $2000 cash advance today!

Disclaimer: Giggle provides Revenue Based Financing programs that are for business purposes only. Any mention of any loan product(s), consumer product(s) or other forms of financing are solely for marketing and educational content purposes and to help distinguish Giggle’s product from other comparable financing options available in the market.