5,000 Dollar Advance

Get Approved for a 5,000 Dollar Loan in Minutes

If you’re freelancing, managing side gigs, or running your business solo, you know that expenses don’t always wait for payday. Giggle Finance offers a fast and simple way to access up to $5,000 in funding. There’s no paperwork to deal with, no long lines to wait in, and no frustrating approval delays.

Our revenue-based financing model is based on your earnings, not your credit history. It’s specifically designed for self-employed professionals and independent workers. With Giggle, you can get the funds you need quickly, without stepping into a bank or digging through stacks of documents.

Get Up to $5,000 Today!

How a 5,000 Dollar Loan Can Make a Difference

Gig workers, freelancers, and self-employed professionals often face unexpected financial hurdles that can’t wait. A $5,000 cash advance can be the difference between maintaining business momentum and falling behind. Many turn to this amount when dealing with major car repairs that affect their ability to work, paying off back taxes, or covering emergency medical bills.

This level of funding also helps cover larger operational costs that often hit all at once. Unlike a small cash boost for quick fixes, $5,000 offers room to plan, act, and grow.

How a $5,000 Advance Can Help Freelancers Stay on Track

Projects come and go, but expenses don’t pause. Freelancers often need to make quick financial decisions, especially when payments are delayed or unexpected costs pop up. Accessing $5,000 can help cover those time-sensitive situations without putting your business at risk.

Some use the funds to handle overdue bills or repair essential equipment. Others put it toward upcoming opportunities, like marketing a new service or purchasing materials in bulk to save money long term. Having access to this level of funding allows you to make those decisions based on what’s best for your work, not just what’s affordable in the moment.

It also brings stability to unpredictable income cycles. Instead of worrying about how to manage during a slow month or waiting on invoices to clear, you have the option to move forward with confidence and stay focused on your work.

Why a Cash Advance Works for Freelancers and Independent Earners

The traditional loan system was never designed for freelancers. Most banks expect W2 pay stubs, tax returns from several years, and a credit score that’s nearly perfect. Even if you gather all the paperwork, the process can take days or even weeks, and that just doesn’t work when you need funding today.

Giggle Finance changes the equation. Instead of judging you by a credit number, we look at your actual income activity. All you need to do is securely connect your business or earnings account. We evaluate your financial data in real time and give you a personalized offer, often within minutes. There’s no hard credit pull, no hidden terms, and no confusing steps.

It’s a streamlined, stress-free experience designed to work with your schedule, not against it.

Who We Are

At Giggle Finance, we understand that not everyone fits into a traditional 9-to-5 job. In fact, we built our entire platform for those who don’t. Whether you’re freelancing full-time, juggling multiple gigs, running your own online business, or doing independent contract work, we’re here to support your journey.

Our mission is simple: Make financing easier, faster, and more accessible for people who earn outside the box. You shouldn’t have to fight for access to funds just because your income looks different. With Giggle, you don’t need perfect credit, collateral, or stacks of documents to get approved.

We see your hustle. And we’re here to make it easier for you to keep going.

What Makes Giggle Different?

Giggle isn’t like traditional lenders. We’ve removed the parts of the financing process that slow you down and replaced them with tools that actually help.

Here’s how we stand out:

- Simple Application – Apply online anytime, day or night, from any device.

- No Hard Credit Check – We use a soft pull, so checking your options won’t impact your score.

- Fast Approvals – Get your offer quickly, sometimes within minutes of applying.

- Tailored to Freelancers – Your eligibility is based on your real income, not just your credit file.

- No Collateral Needed – Keep your assets safe. Our advances don’t require you to put up property.

Everything we do is designed to fit into your freelance lifestyle. Whether you’re sending invoices at midnight or picking up extra work on weekends, Giggle is ready when you are.

Not a Traditional Loan, and That’s a Good Thing

Many loans come with strict repayment plans and interest rates that don’t work for people with variable incomes. Giggle offers something different. Our cash advances are not loans in the traditional sense. Instead of locking you into a fixed plan that ignores your actual earnings, our funding adapts to your income.

There’s no hard credit check, no in-person meetings, and no piles of forms to fill out. You won’t need to upload dozens of PDFs or print documents to prove you’re eligible. Giggle’s automated system does the heavy lifting behind the scenes, giving you a funding offer quickly and with full transparency.And if you don’t need the full $5,000, that’s okay. You can explore related offers like our $2,000 and $1,000 funding options, depending on your current goals. Whether you’re handling a slow season or ramping up for a new opportunity, Giggle gives you flexible options without locking you into unnecessary debt.

How to Apply for a $5,000 Advance from Giggle

Getting started is simple. You don’t need a business degree to understand our process. Here’s how it works:

Step 1: Check Your Eligibility

We’ll ask you a few basic questions and invite you to connect your earnings account securely. This allows us to view your income patterns without impacting your credit score.

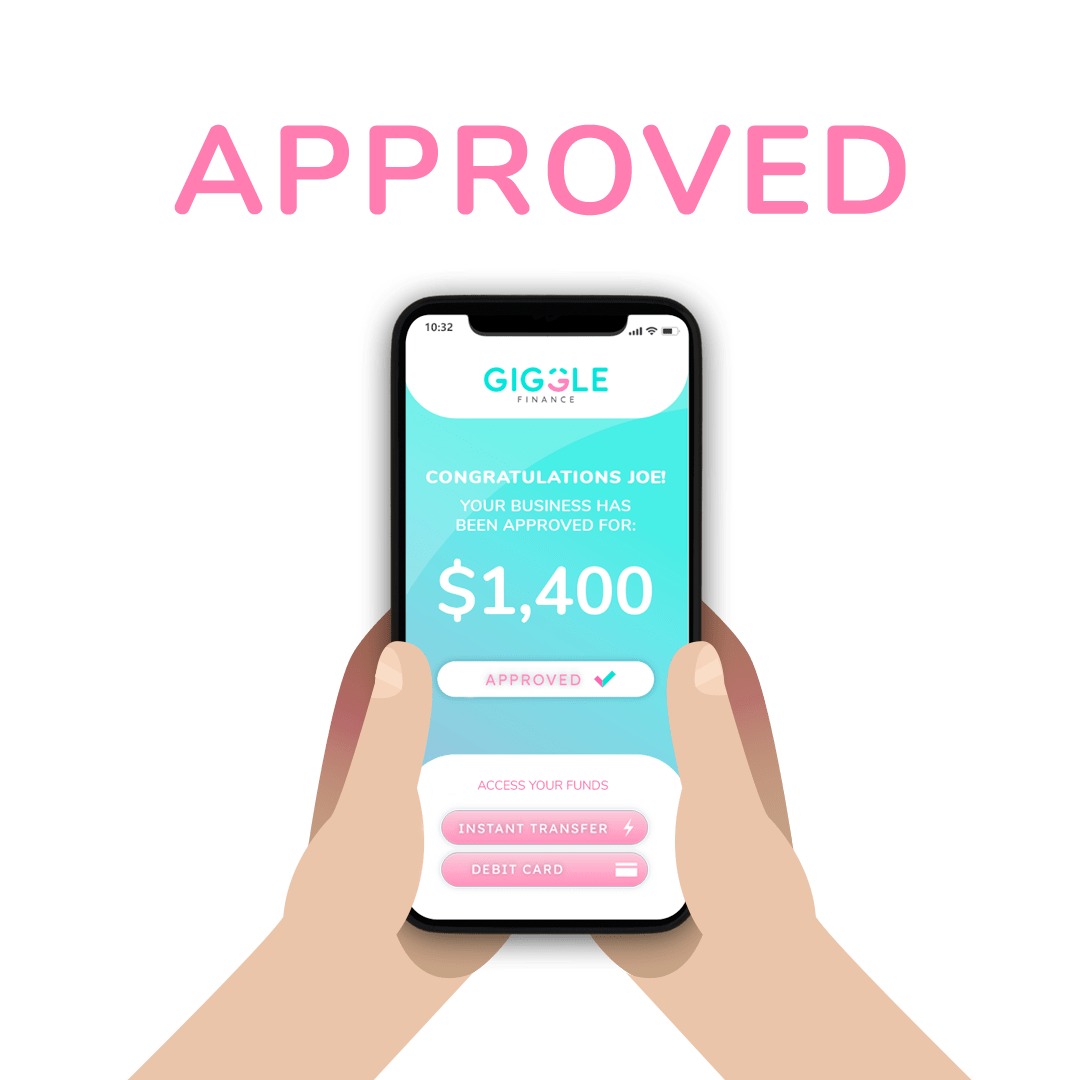

Step 2: See What You Qualify For

After we assess your information, you’ll get a clear offer showing how much you qualify for. This might be the full $5,000 or a smaller amount based on your income, like $2,000 or $1,000. The terms will be easy to understand, with no fine print or confusing language.

Step 3: Access Your Funds in Minutes

Once you accept your offer, the money goes straight to your account. In many cases, it arrives the same day, sometimes even within minutes. You can use it right away for whatever you need most.

Smart Ways to Use Your $5,000 Cash Advance

Funding is only useful if you know how to use it well. Many freelancers and gig workers are using their Giggle advance to improve their work, manage risk, and grow their business. Here are a few real-world examples of how to put $5,000 to work:

Upgrade Tools or Equipment

A faster laptop, upgraded camera, or noise-canceling headphones can instantly improve your efficiency and the quality of your work.

Cover Business Expenses During Slow Periods

If you experience seasonal lulls or delayed payments, an advance can cover rent, subscriptions, and other ongoing expenses until your next project starts.

Pay Off High-Interest Debt

Freelancers often rely on credit cards. A cash advance with more favorable terms can help you reduce your interest costs and pay off balances faster.

Launch or Expand a Side Hustle

Got an idea you’ve been waiting to try? Use the funds for a basic website, ad campaign, or tools to test a new offering or reach a different audience.

Handle Emergencies Without Derailing Your Plans

Put some of the money aside for emergencies or use it to create a safety net so you can say yes to the opportunities that matter and no to the ones that drain your energy.

Here’s how to apply:

Step 1: Complete the online application

We’ll only need basic information about your business and your banking details. Don’t worry; we’ll keep your data safe, and they’re never stored, viewed, or displayed.

Step 2: Wait for approval.

Once you’ve submitted your application, approval is granted instantly. You’ll be able to review the terms, rates, and how much you qualified for.

Step 3: Receive your Giggle advance.

After approval, we’ll wire the money into your account immediately.

How to Use a Giggle Advance

You can use the funds from a Giggle advance for almost any type of expense, but here are some of the most common ways to use it:

1. Marketing and Advertising

Many gig workers forego paying for marketing and advertising because they usually cost a lot of money upfront. However, marketing is a necessary expense that you need to invest in because it improves brand awareness and visibility and allows you to connect with your customers. You can use a gig advance to pay for the services of marketing agencies or promotional materials like SEO, social media ads, radio spots, and more.

2. Having a Cash Cushion

Cash cushions are essential in addressing unforeseen expenses, sales fluctuations, and shifts in the market. Seasonal businesses, gig workers, and freelancers must have enough cash to offset irregularities in revenue. Giggle Finance’s fast approval and funding will give you peace of mind knowing that you’ll have access to funding when you need it.

3. Increase Working Capital

Increasing capital is one of the main reasons why gig workers take out a $400 to $2000 loan. Inconsistent revenue and seasonal sales can negatively affect your cash flow. You can use the funds of a Giggle advance to pay for day-to-day expenses and bridge cash flow gaps so you can continue running your gigs.

Frequently Asked Questions

What can I use a $5,000 advance for?

It’s completely up to you. Giggle doesn’t place restrictions on how you use your advance. You can use the funds for business equipment, car repairs, rent, inventory, or paying off high-interest bills.

Will applying affect my credit score?

Not at all. We only use a soft credit pull, which means there’s no impact on your credit score during the application process.

Can I still get a $5,000 advance if my credit isn’t great?

Yes. Your credit score doesn’t need to be perfect to qualify. Giggle focuses more on your income and work activity than on traditional credit factors. If you’ve got a steady flow of payments coming in from your freelance or gig work, you still have a strong chance of getting approved, even if your credit history isn’t ideal.

Do I need to put up collateral to get a $5,000 advance?

You don’t need collateral to qualify for a Giggle advance. Unlike some traditional lenders who might ask you to secure a loan with your car or other assets, Giggle offers unsecured funding. You don’t have to risk personal property to access up to $5,000.

How quickly can I access the money?

In many cases, you can get funded the same day you apply. Giggle is built for speed, so there’s no waiting on banks or business hours. If you’re approved, the money goes straight to your account so you can use it right away.

How do I repay my $5,000 cash advance?

Repayment depends on the type of advance and the agreement you make with your provider. Some may require one-time repayment on a specific date, while others offer flexible options with smaller, recurring payments over time.

With Giggle, payments are based on your business revenue, so there’s no pressure if things slow down. Just make sure to stay on track with your agreed schedule to avoid extra fees. If you ever run into trouble, just reach out. There may be ways to adjust your plan. And remember, borrowing more to cover an existing balance can lead to more stress, so it’s best to explore solutions early.

Disclaimer: Giggle provides Revenue Based Financing programs that are for business purposes only. Any mention of any loan product(s), consumer product(s) or other forms of financing are solely for marketing and educational content purposes and to help distinguish Giggle’s product from other comparable financing options available in the market.