Financing for Self Employed Professionals

Financing for Self-Employed Professionals

There are many wonderful benefits of being self-employed—leaving the 9-5, following your passion, becoming your own boss, and choosing when you work. But, like other small business owners, access to financing for self-employed professionals can be challenging.

Lenders often look for consistency and stability in income from loan applicants, and this can work against most self-employed professionals with inherently unpredictable revenue streams. Additionally, documentation requirements are stringent and directed toward W-2 workers who receive regular and consistent income every two weeks. As a result, lending institutions are hesitant to lend money to small businesses and freelancers.

At Giggle Finance, we believe that self-employed professionals deserve fast and transparent financing. It’s easy to apply and only takes a matter of seconds. Today, self-employed professionals have only a few options, such as predatory Payday Loans and self-employed loans. However, with a Giggle Business Advance, the cash is tailored to suit your needs, whether you’ll use it for renovations, debt consolidation, or additional capital.

What We Do

Giggle Finance is an online finance platform dedicated to helping self-employed professionals and small business owners quickly access capital when they need it.

We Help Build Your Financial Future

Our goal is to help build your financial standing without affecting your credit score. Unlike a self-employed loan with fixed payment terms, the funds from a Giggle Business Advance provide greater payment flexibility so your business can continue moving forward.

If you work with us, you’ll join other self-employed professionals and small business owners who access instant and affordable funding whenever they need it.

How a Giggle Business Advance Works

A Giggle Business Advance allows self-employed professionals to access working capital by selling a percentage of their future sales. You’ll receive the funds in minutes and repay the advance through automated debits, plus a small service fee until paid in full.

We don’t have a minimum credit requirement. Instead, we look at your bank statements and other financial documents to determine how much you can afford. We require at least three months in business to qualify for an advance, making it a perfect option for newly self-employed professionals.

Have some questions about our process? Check out our Frequently Asked Questions here.

Why Choose Giggle Finance

We’re here to revolutionize small business funding through the latest technology, exceptional customer service, and transparency.

1. Immediate Approval

Instant application approvals so you can review your terms and know how much you qualify for in minutes.

2. Instant Cash

We’ll wire the money into your bank account within minutes. You can immediately use the funds for any pressing business needs.

3. Simple Application Process

It takes less than eight minutes to fill out our fully-automated application and get funded.

4. Funding Up To $10,000

Self-employed loans typically cap at $2,500, with Giggle Finance you can qualify for a business advance for up to $10,000.

5. No Credit Requirements

We don’t have any credit score or history requirements. Bankruptcy, medical bills, or foreclosures? All NO problem!

6. No Hidden Fees

We believe that transparency and integrity build trust, so we make sure that our application process and contracts are easy to understand, with no hidden fees.

7. Flexible Payment Schedule

Payments are automatically debited from your account until the advance is paid in full.

8. Fully Secure

We value your privacy, so we made sure Giggle operates using 256-bit encryption. This means that your personal information and passwords are never viewed, displayed, or stored.

A Giggle Finance Application is as Easy as 1, 2, 3!

We know that self-employed professionals have a lot on their plate; that’s why we want to keep our application process as simple as possible.

Our online application process only takes less than 8 minutes to complete. Tell us a few details about your business and securely connect your bank account. Approval is instant, and you’ll receive the amount you’ve qualified for in minutes.

Step 1: Complete the online application

We’ll ask for basic information about your business and your banking details.

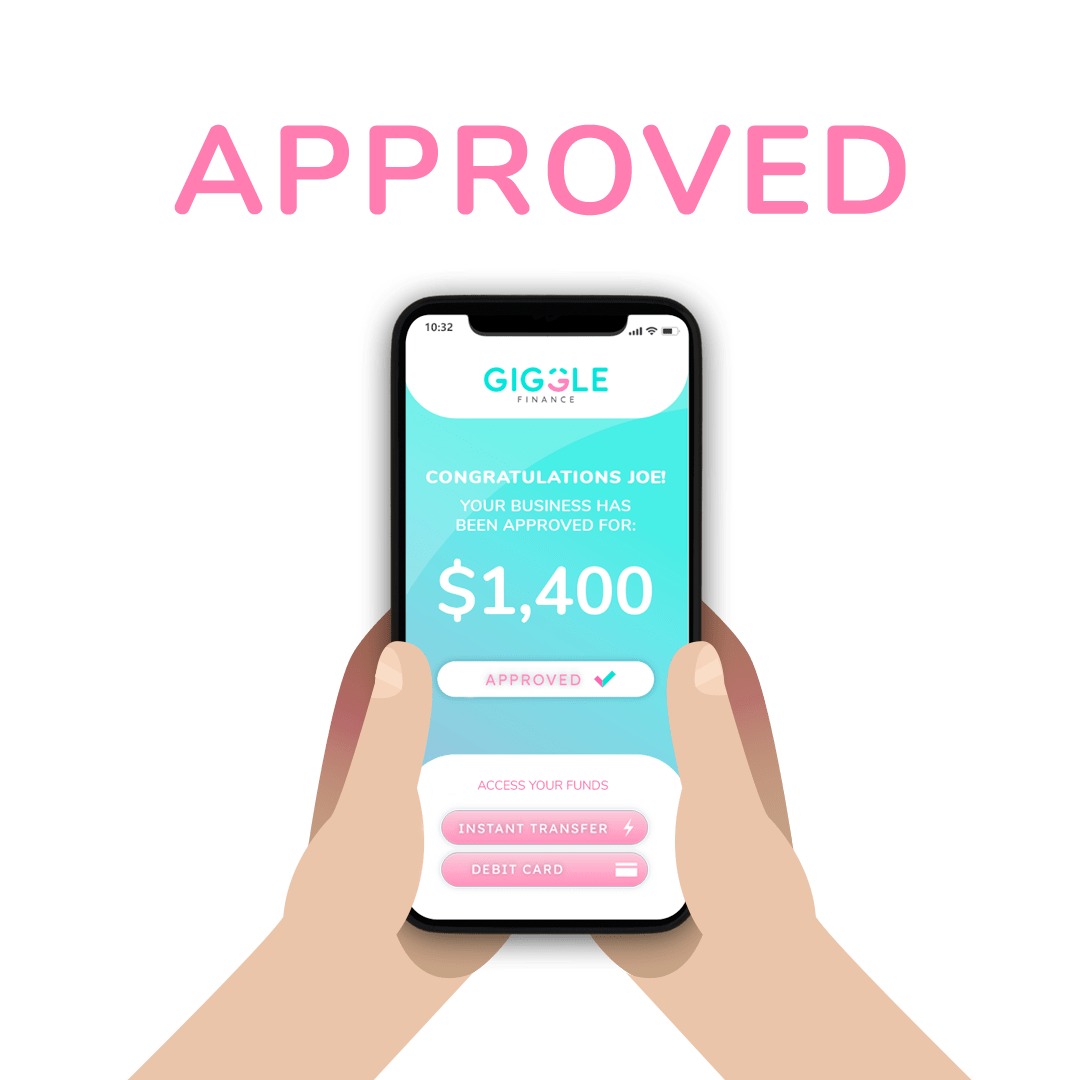

Step 2: Approval

You’ll know the status of your application immediately. We’ll send you details regarding rates, terms, and how much you qualify for.

Step 3: Get funded

Once approved, we’ll make an electronic fund transfer to deposit the money into your account immediately. You can instantly access your funds and use the money as you deem fit for your business– for additional capital, inventory, hiring – it’s all up to you.

How to Use the Funds from Self Employed Loans or even better – a Giggle Business Advance

Here are some of the most common ways self-employed professionals use the funds from the Giggle Advance:

1. Marketing and Advertising

Investing in marketing is a necessary expense for self-employed professionals who want to grow and expand their operations. Effective marketing can help attract new customers, keep existing ones, improve brand visibility, and generate a higher return on investment (ROI).

With a Giggle Business Advance, you’ll have the financial resources needed to invest in marketing software, hiring new staff, or the services of a marketing agency.

2. Investing in Your Employees

The people who work for you are your most valuable assets, so it makes sense to invest in their personal and professional development. You can do so by offering perks and benefits tailored to their needs and preferences. For example, if you’re in the trucking business and your employees are going above and beyond their work, you can give them additional benefits or overtime pay with a truck driver loan. Giggle Finance opens more opportunities for your employees to feel secure and valued.

3. Inventory

You can use the advance to replenish inventory that’s running low or take advantage of a bulk discount deal. An updated inventory opens your business to new markets and attracts more people.

4. Additional Working Capital

Additional working capital is one of the main reasons why self-employed professionals apply for a Giggle Business Advance. Inconsistent revenue streams and seasonal sales fluctuations can put a dent in your cash flow. The funds from Giggle help you to bridge cash flow gaps so you can continue running your business.

5. Refinance Another Loan

Taking out an advance to pay for another loan may seem odd, but debt refinancing is also a common reason to apply for a Giggle Business Advance. It’s an excellent option for self-employed professionals to use funds to pay off their debts and have extra cash for other necessities.

6. Expand Your Products and Services

Expanding your products and service lines can increase your revenue and help you stay competitive with your peers. A Giggle Business Advance allows you to make the necessary investments to keep your business relevant. Whether you need a 500-dollar advance or 5,000-dollar additional cash, you can get them at Giggle Finance.

Disclaimer: Giggle provides Revenue Based Financing programs that are for business purposes only. Any mention of any loan product(s), consumer product(s) or other forms of financing are solely for marketing and educational content purposes and to help distinguish Giggle’s product from other comparable financing options available in the market.