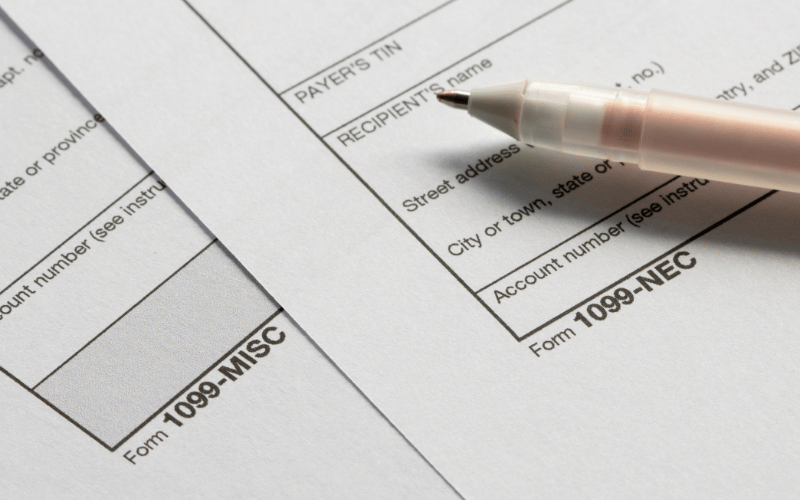

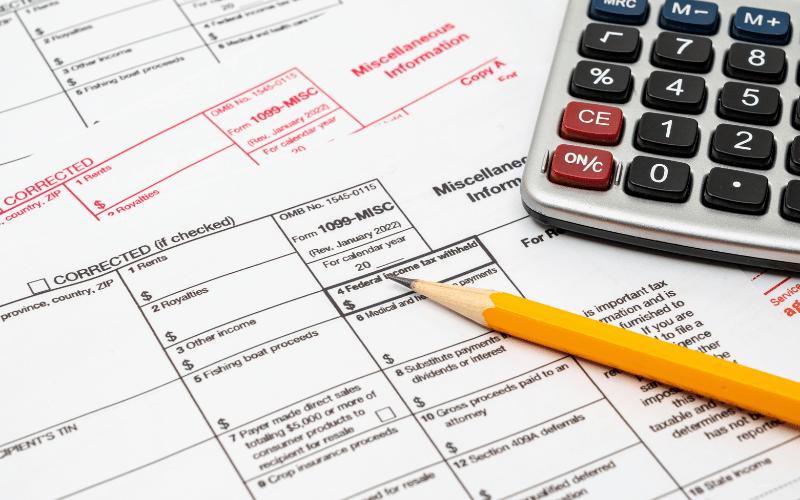

Understanding the distinction between independent contractors and vendors is important for businesses aiming to thrive in the gig economy. This knowledge plays a significant role in decision-making processes related to task delegation, budget allocations, and legal responsibilities. By knowing the difference between independent contractor vs. vendor, you can enhance your company’s project outcomes and ensure […]

The term “1099 vendor” is increasingly prevalent in today’s gig economy. But what exactly does it mean, and why is it important for both businesses and independent contractors to understand this classification? Correctly identifying 1099 vendors is crucial to adhering to tax laws and ensuring fair treatment for workers. This blog post covers the specifics […]

The bond between humans and dogs is timeless, and the demand for dog walking services has never been higher. Whether it’s because of busy work schedules or the need for pets to get their daily exercise, dog owners are constantly on the lookout for reliable and caring individuals to take their furry friends for […]

In the fast-paced world of freelancing, where independent contractors and 1099 employees navigate through tight deadlines and diverse projects, efficiency isn’t just a goal—it’s a necessity. With the right tools, these professionals can significantly enhance productivity, streamline operations, and elevate work quality. That’s where technology steps in, offering various solutions without the hefty price tag. […]

As a self-employed freelancer or contractor, staying productive and organized is essential for success in the diverse and fast-paced gig economy. Fortunately, several apps and tools are available to help you streamline your work, manage your projects, and enhance your overall efficiency. In this blog post, we will look into the best apps for self-employed […]

Once you start your career as a DoorDash driver, knowing how to get pay stubs from Doordash is essential for various reasons, such as tax filing and personal record-keeping. Accessing your DoorDash pay stubs is a straightforward process, and this guide will take you through the necessary steps to obtain this crucial information hassle-free. What […]

If you’re a dedicated Uber Eats delivery driver wondering how to switch from Uber Eats to Uber driver, you’re in the right place. The transition might not be a one-click affair, but worry not — it’s entirely doable. In this guide, we’ll walk you through the complete process of switching from Uber Eats to Uber […]

As a business owner or professional, you need to understand the possible repercussions of not filing 1099 forms. One of the most common questions asked is, “What is the penalty for not issuing a 1099?” Knowing the answer to this query ensures your compliance with IRS regulations and helps you steer clear of potential pitfalls. […]

In the gig economy, more and more people are embracing self-employment. Whether you’re a freelancer, consultant, or run a small business, you might find yourself receiving income without the traditional 1099 form. So, what do you do when you have self-employment or cash income that doesn’t come with a 1099? In this guide, we’ll explore […]

If you’ve been working as an independent contractor or freelancer, you’re probably familiar with Form 1099 — an essential document for tax reporting. What happens if an employer does not send you a 1099? In this blog, we’ll explore the basics of the form, why you might not receive one, and what to do if […]